What was Satoshi Referring to?

The quote was in reference to an article published on the 3rd January 2009 from The Times entitled, ‘Chancellor Alistair Darling on brink of second bailout for banks’.

‘The Chancellor will decide within weeks whether to pump billions more into the economy as evidence mounts that the £37 billion part-nationalisation last year has failed to keep credit flowing. Options include cash injections, offering banks cheaper state guarantees to raise money privately or buying up “toxic assets”, The Times has learnt.’

This was a response by the UK Government to the Global Financial Crisis that began in 2008 which began with the pop of a monstrous housing market bubble caused by the banks selling millions of toxic subprime mortgages to the public around the turn of the 21st century.

Subprime mortgages are built with the poor in mind. They are offered to those with poor credit histories, basically, the poor. As you’d expect in this topsy-turvy world, these subprime mortgages for the poor had vastly higher interest rates making the mortgage payments almost impossible to keep up with. But fear not, in the banks infinite wisdom they assisted these borrowers in their monthly payments by issuing interest-only loans.

The problem was, these interest-only loans only had a fixed rate for between 1 and 5 years, and then the rate increased to well above the base rate. Before long, millions of borrowers were defaulting on their mortgages and the giant snowball began its path of destruction down the economic hill destroying everything in its path!

There were many other greed based economic shenanigans going on under the hood of the banks, pension funds and hedge funds, all which played their part in catastrophically bringing down the financial system which ultimately led to the bank bailouts of 2009. But the thing to note here is that it was entirely the fault of the global financial system.

There are those who will try to attribute blame on the common man and woman. ‘They were being greedy’, they will say. ‘They knew they couldn’t afford that house’ they’ll tell you – but what these accusations fail to point out is the fact that the snake oil salesman working on behalf of the bank cold calling just about every household in the west sold the dream to everyday people who had only dreamt of ever being able to own a home.

Let us not forget that banks and the financial system were generally held in high regard by most people at that time. People still dressed up smartly to see their bank manager. This was an institution that many still respected and trusted. If the bank told them they could buy their house, why wouldn’t it be true?

The financially uneducated were the target victims in this scam and while the ripple effects of the collapse travelled a long way up the pyramid of wealth, it was the working and middle-class that got battered the hardest.

10 Million Americans and millions more throughout the UK and Europe lost their homes. Unemployment began to skyrocket as the public’s cash began to dry up. But, the governments had a plan!

Bye Bubble, Hi Bubble!

The US put together a package to bail some of the major banks out of trouble. The Troubled Asset Relief Program saw the US Government buy $700 Billion of banks junk assets. The UK went a little further and amassed over $1 Trillion of taxpayers money to bail out the banking system. That was over $15,000 for every man, woman and child in the country.

The argument was, these banks were ‘too big to fail’. The argument was that even though these banks had misused their position and misled the public, their failure would only cause more harm to the already hurting victims of the crisis. These initial measures set the foundation, next came the stimulus!

QE1

On November 25, 2008, the Federal Reserve announced the first round of quantitative easing (QE1) in response to the financial crisis. Fed Chairman at the time, Ben Bernanke, announced an aggressive attack on the crisis, which included the purchase of $500 billion in mortgage-backed securities and $100 billion in other debt which we mentioned earlier, but it didn’t end there. The QE1 program carried on until 2010, by which time the FED’S portfolio of securities had accumulated to a whopping $2.1 Trillion.

The UK similarly put almost another trillion into the UKs money supply through the purchase of UK Government Bonds by the Bank of England.

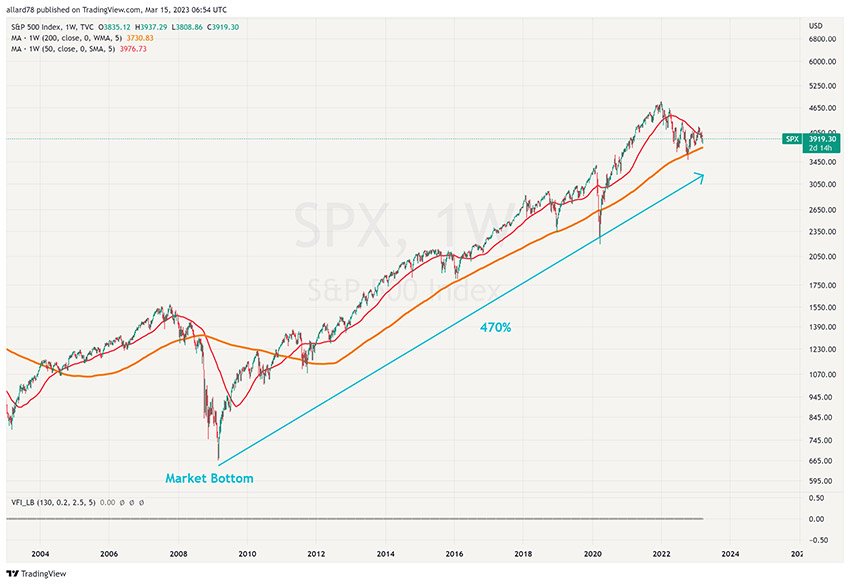

On March 9th 2009 the markets bottom out. Since then, we haven’t looked back! The good times were back again and nothing was gonna get in our way!

But it didn’t end with QE1. In late 2010 we saw the FED pump another $800 billion into the money supply and again in 2013 we saw QE3 pump another $85 billion per month of liquidity to the money supply.

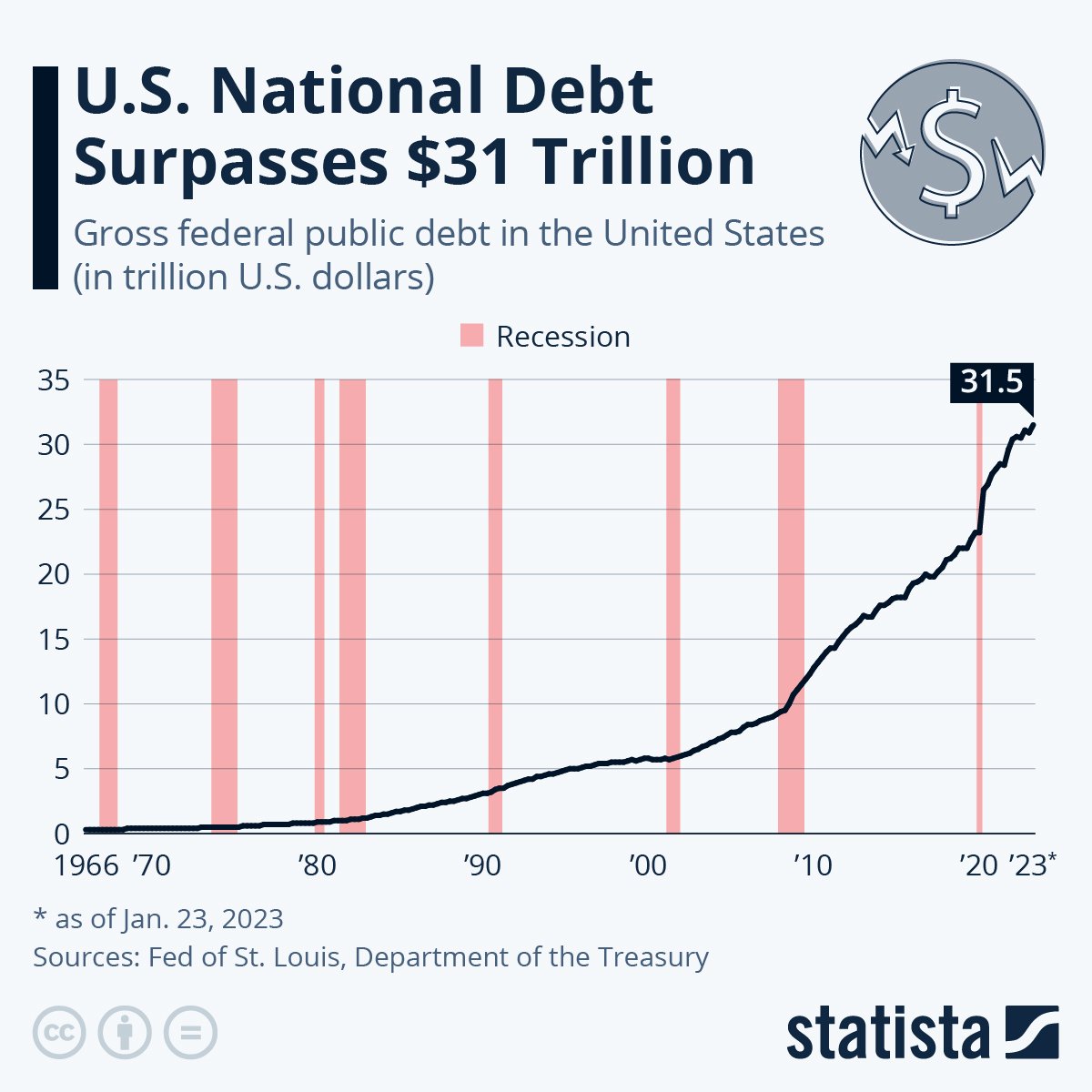

Since 2009 we have seen the US Government’s total debt grow at an exponential rate from just under $10 trillion to a staggering (and it gets worse…) $31 trillion

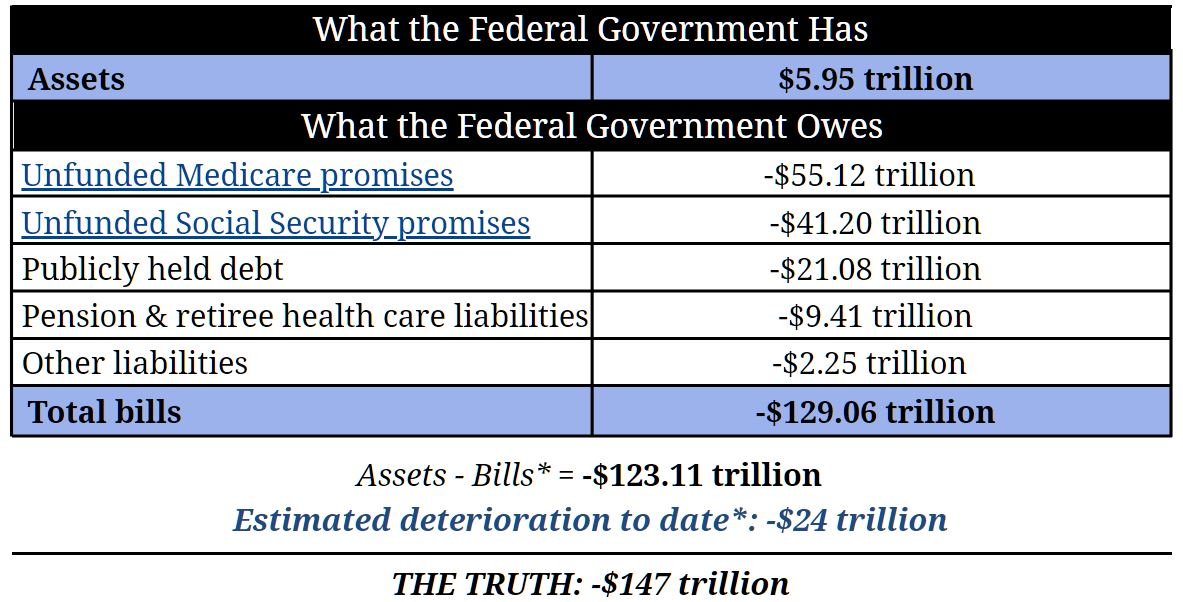

But in actual fact, US debt is far greater than that if we take into account all of its liabilities:

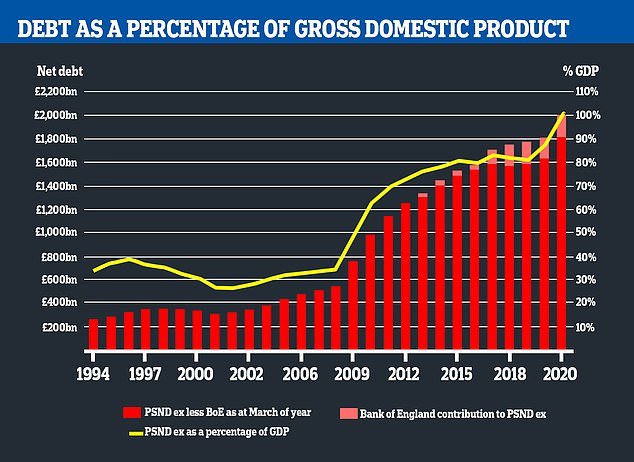

The UK has also followed the same trajectory since 2009:

The current economic model is built on a system of debt. We can see this filter down from the government to the everyday man and woman just trying to make ends-meet. Have you ever tried surviving without debt?

I have, and it isn’t easy. With the cost of living increasing by the day (literally), and wages continuing to stagnate, when trouble erupts finding the means to bail yourself out is becoming ever harder, without debt at least. Debt plays a vital part of the majority of households throughout the western world. It allows consumers to consume prior to earnings, it helps people get themself out of a bind when disaster hits. Which is all well and good, but what happens when everyone’s debt buffer is reaching its limit? What happens when there is no more debt to issue?

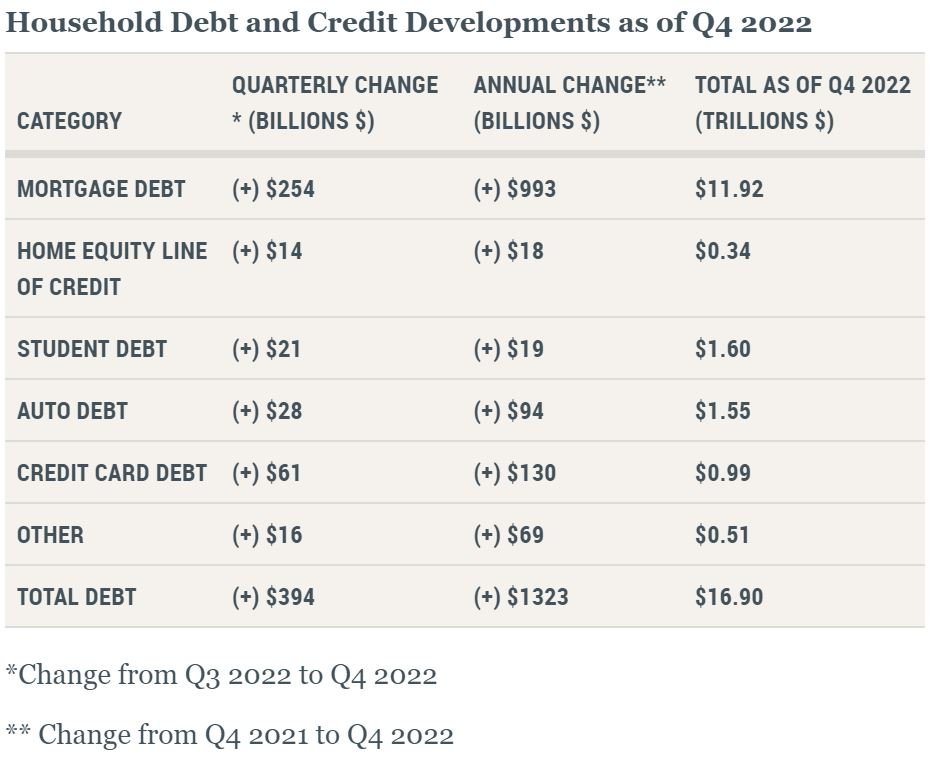

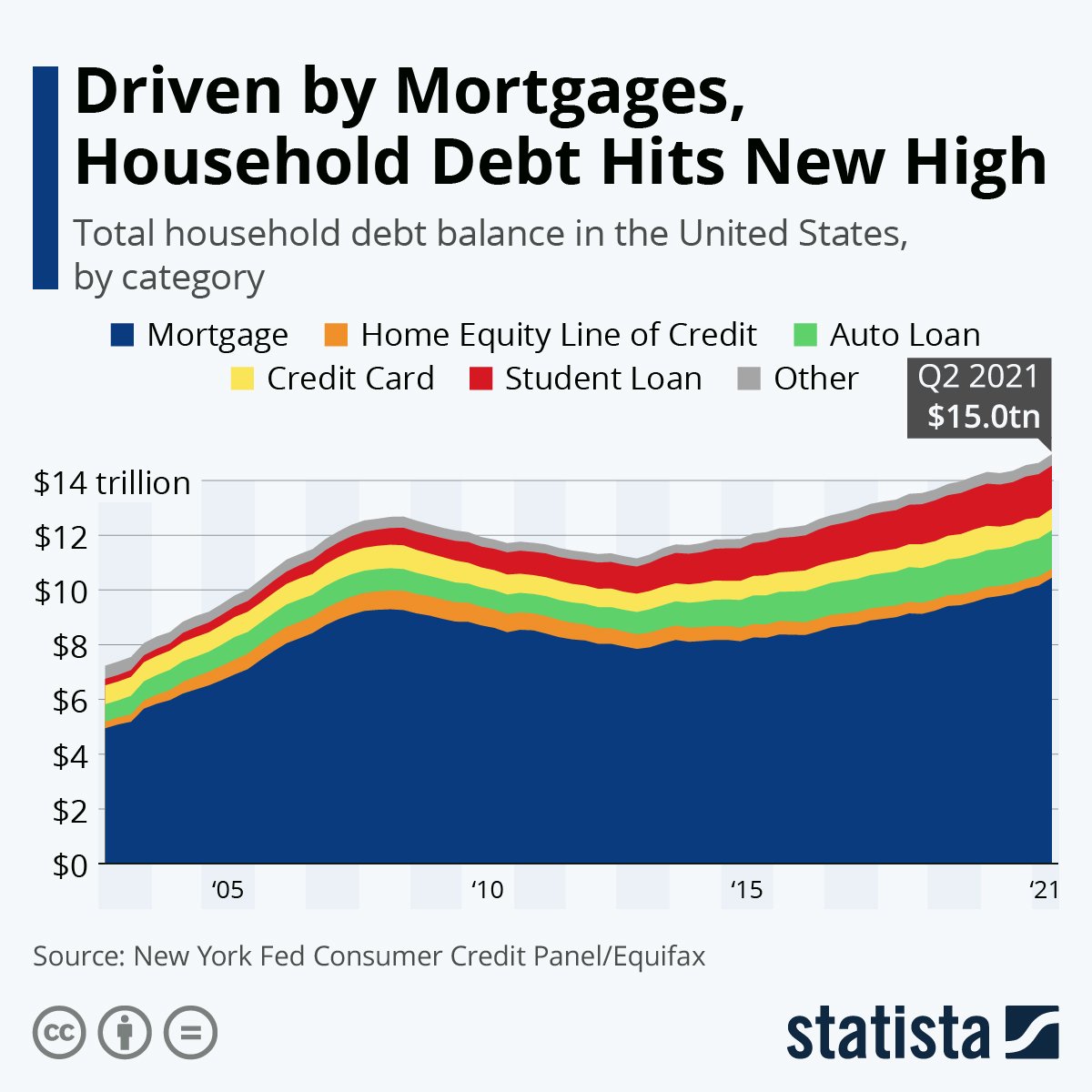

Consumer debt in the US is at its highest levels ever and the number of consumers defaulting is on the rise:

That’s just shy of $17 Trillion in household debt as of the end of 2022.

Fast Forward…

A lot has happened since the financial crisis of 2008-2009. We had the continuation of the ‘war on terror’ which began post 9/11 in the Bush Jr. era. We’ve had the split of the UK from the EU. And, you may remember a recent incident where a global consensus was agreed upon to lock everyone up in their houses, close down businesses and begin feeding 24 hour news coverage of misinformation with the sole purpose of generating fear in every man, woman and child in the World.

All of the above has generated yet more government debt, more household debt and some extra goodies like a pending health catastrophe and societal breakdown. Supply chains are broken, relative poverty is on the rise, famine whispers in the dark and the general sentiment of the people regarding their government is, ‘they’re a bunch of lying crooks’. Which of course they are. But when this sentiment moves into the minds of those traditionally very obedient to the state and willing to excuse fault by their masters it is a sure sign that trouble is brewing.

Here in the UK we have most public services now striking. The Police are overwhelmed, the hospitals are overwhelmed, the roads are deteriorating, drug and alcohol abuse are exploding, homelessness is visibly growing and the general grocery shop conversation seems to be about who just died of a heart attack and some poor family down the road who just got kicked out of their house. And… I didn’t even touch on the cost of energy prices here in the UK.

I’m not a doomsdayer, I almost was – it often felt like the easiest road to go down once you’d immersed yourself in the truths behind our past and present. But, it’s an ugly path with no hope and so I chose to always look on the bright side, always look for the opportunity and seek prosperity no matter what happens.

There is hope, in fact, I feel more hopeful today than I ever have before. We have people from all walks of life beginning to question the lies that have been fed to them for so long now. People are questioning whether they will even bother to vote in the next general election and… people are beginning to understand that what they thought was their money in the bank, is in fact, not ‘their money’ at all.

Bitcoin was built for this

Satoshi saw the looming banking catastrophe. He or she saw the inherent flaws in the current monetary system. Bitcoin, as simple as it is, solves it all. Most early bitcoin adopters understood this. Often stumbling across bitcoin in forums discussing the criminal bankers and the debt based system they upheld. Bitcoin offered a new form of money that anyone could transact with. There were no barriers to entry, there were no rules or restrictions on who you could transact with and how much you could transact. The supply was hard wired into the code ensuring no one person or entity could decide to print some more money.

As Bitcoin grew and became a household name, much of this initial admiration fell into the background. It became the thing that ‘kept going up’. It became the ‘money of criminals’ and the thing that made bob down the road a millionaire. Bitcoin had made the big time, but its real purpose was largely forgotten.

Until now that is.

Run, Run, Bank Run

‘Americans with accounts at under-pressure banks flocked to branches to withdraw funds on Monday after the collapse of Silicon Valley Bank.’

As news shook the world of the collapse of yet another major bank, depositors flocked to their local SVG branches to pull their cash.

And really, why wouldn’t you? The natural response by any rational and sane individual who had just heard news that the bank where they deposited all their hard earned cash was ‘collapsing’ is to get that money out!

Any rational person who didn’t even bank with Silicon Valley Bank is going to be, or at least they should be, considering pulling cash from whatever bank holds their funds.

So, what exactly happened at Silicon Valley Bank?

Most banks, including Silicon Valley Bank(SVB), hold billions of dollars worth of Treasuries and other bonds as they are considered safe investments. However, the value of previously issued bonds has started to decline due to lower interest rates compared to comparable bonds issued in today’s higher interest rate environment. Normally, this would not be a problem since bonds are considered long-term investments, and banks are not required to record declines in value until they are sold. Bonds are not sold at a loss unless there is an emergency, and the bank needs cash urgently.

Unfortunately, Silicon Valley Bank, which collapsed last Friday, faced an emergency. Its customer base consisted mostly of startups and other tech-centric companies that needed more cash over the past year, leading to a wave of deposit withdrawals. The bank was then forced to sell a significant portion of its bonds at a steep loss, and as news of the bank’s financial difficulties spread, the pace of withdrawals only increased. This effectively left Silicon Valley Bank insolvent.

Third Major Bank to Fail in just a few days

The collapse of SVG follows a spout of recent banking collapses. Other banks that recently closed their doors to depositors were Silvergate and Signature Bank.

As panic ripples through the financial system, politicians attempt to reassure depositors that ‘their money is safe’.

“Americans can rest assured that our banking system is safe. Your deposits are safe,” – President Joe Biden

But they are only safe if this message satisfies the fears of depositors and they refrain from attempting to withdraw their money. If panic continues and depositors continue to flock to their local branches to withdraw cash this could snowball out of control. After all – no bank can satisfy all of their depositors balances in cash, that is the beauty of fractional reserve banking.

Bitcoin is a bank, but different

Bitcoin is a bank that doesn’t lend, it doesn’t invest, it doesn’t gamble, debase, dilute, or freeze your assets. Bitcoin works every hour of every day regardless of financial catastrophes. Bitcoin is unstoppable and ready to satisfy the balance of all of its depositors.

And it seems recent events may have just woken people up to this idea that Bitcoin is more than just a speculative asset to ‘get rich quick’. As news struck of SVGs collapse, people have flocked to the obvious safe haven – Bitcoin.

Demand for Bitcoin has skyrocketed breaking major resistance levels. With a 33% rise in the price of bitcoin since the collapse of SVG and with further catastrophe’s imminent in traditional finance, Bitcoin is king.

Bitcoin doesn’t care if you think ‘it doesn’t exist’, or that you think it might be ‘a trojan horse sent by the new world order to destroy us all!’. It doesn’t care if you don’t understand it, or think it is something akin to gambling or beanie babies. None of this matters. Bitcoin continues to write blocks, every 15 minutes and with every block it carefully checks the transactions and balances, confirms their authenticity and records them forever on-chain.