Many years ago, I wrote an article entitled ‘Satoshi’s Circus’, it was simply a comical look at the wild west of cryptocurrency, a delve into the lunacy that followed Satoshi’s World changing whitepaper back in 2009. Years later I think I could easily expand on the article, so much so I think it may be worthy of a book by the same name.

The article opened a little something like this:

‘Roll up, Roll up and come on down to the greatest show the World has ever seen, we have coins with dogs on, we have coins for ponzi’s, we have coins for getting high, we even have coins to help you purchase a little fun between the sheets.

Yes, that’s right, here at Satoshi’s we have it all, from thirteen-year-old ‘Wolf of Wall Street’ loving traders who just love to spend their days pumping altcoins using their pocket money while just teetering on the edge of ‘getting Rekt’ to the notorious supervillain George Soros, who only just joined us here at Satoshi’s Circus—Soros and his ‘Mary Poppins’ style pockets of cash is on board and ready to go!

With 24 hours around the clock Crypto Twitter fun and trading that never stops, Satoshi’s Circus will literally blow your fricken mind. It’s been known to make grown men cry about other people calling Bitcoin Cash, Bcash. Satoshi’s house of fun accepts everyone and denies nobody, yet it is unforgiving while giving – it can take away your house while delivering a Lambo for another.

This is the place where dreams are made, where new eras begin and old eras end, a place where Governments could be made obsolete and the very essence of life itself can be tokenized. Your journey has ended, but your destiny awaits.

Welcome to Blockchain, welcome to Cryptocurrency, welcome to Satoshi’s Circus.’

While I mock the cryptocurrency space, please don’t think for a second, I’d have it any other way. Bitcoin changed my life, in fact, in many ways, life began for me when I first stumbled across it a decade ago. For the first time in my life, people I could relate too, people who had common morals and beliefs as me, were all coming together around this new decentralized money. Finally, I had found my people. For this reason, I call myself a Bitcoin maximalist, though unlike many other maximalists out there, I do see the merit in other cryptocurrencies.

However, just for a moment I’d like to give Bitcoin the credit and attention it deserves. The circus has grown ever larger, and with it so has the common disregard for Bitcoin.

Bitcoin Health Check

While everyone is glued to the charts and ever accumulating red candles, I’d like to take a look at some other bitcoin data points. Price discovery in the markets is important, but it is also cyclic and driven by emotion, particularly in the short term. To get a better understanding of how price discovery may behave one year, five years and even ten years from now it may be better to take a look at Bitcoin at a protocol level.

So, let us begin with the Bitcoin Hash Rate.

As you can see the Bitcoin hashrate has continued to grow steadily over the past few years with little sign of relief. Just a few days ago on 12th June 2022 we saw the hashrate hit an all-time high of 231 EH/s, at the same time Bitcoin price began to plunge below $25k.

Hash rate has little to no correlation to bitcoin price in the short term, it does however give us an idea of miner sentiment of the network looking forward. Just to show you how uncorrelated these two data points are, here is a pretty chart for you:

The only correlation is that over time, they both go up.

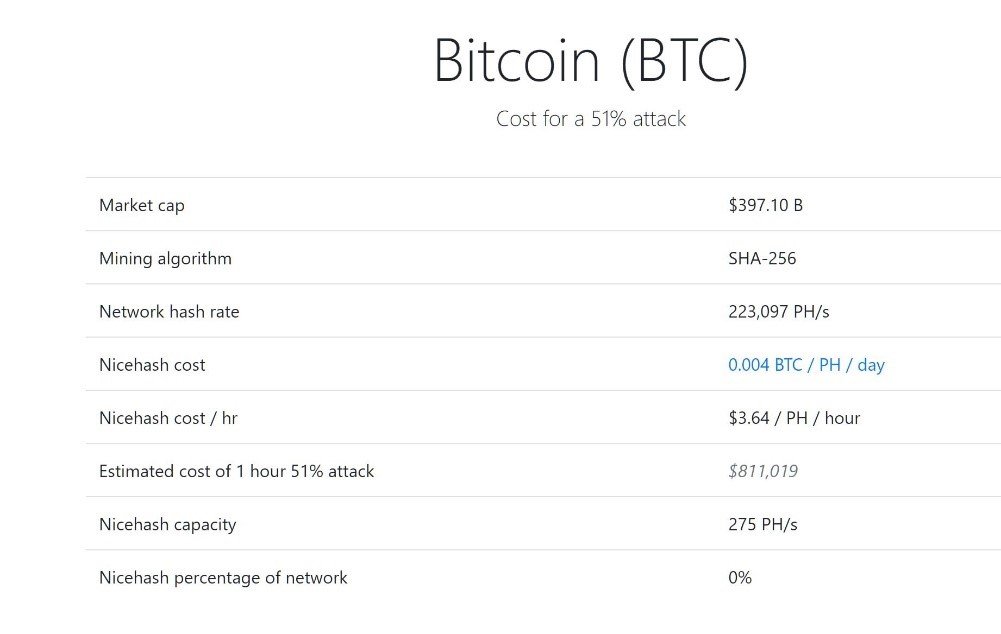

The network is as strong as it’s ever been, which in turn means the network is as secure as it’s ever been and its vulnerability to a 51% attack is at its lowest ever.

Now while $811,019 may seem not a huge amount to attack the network for an hour, this value is misleading as it assumes there is enough technology available to perform such an attack. Which, there isn’t. To attack the network, it would require existing hashrate to opt-out of honest mining and jump on-board with the attackers. Logistically it is far more costly. But also, an attack would likely take more than a day to achieve, assuming you are lucky and then as an attacker you’d have to consider the fact that the attack would drive the price down of Bitcoin. In a nutshell, the network is secure, or at least more secure than any payments network that has ever existed.

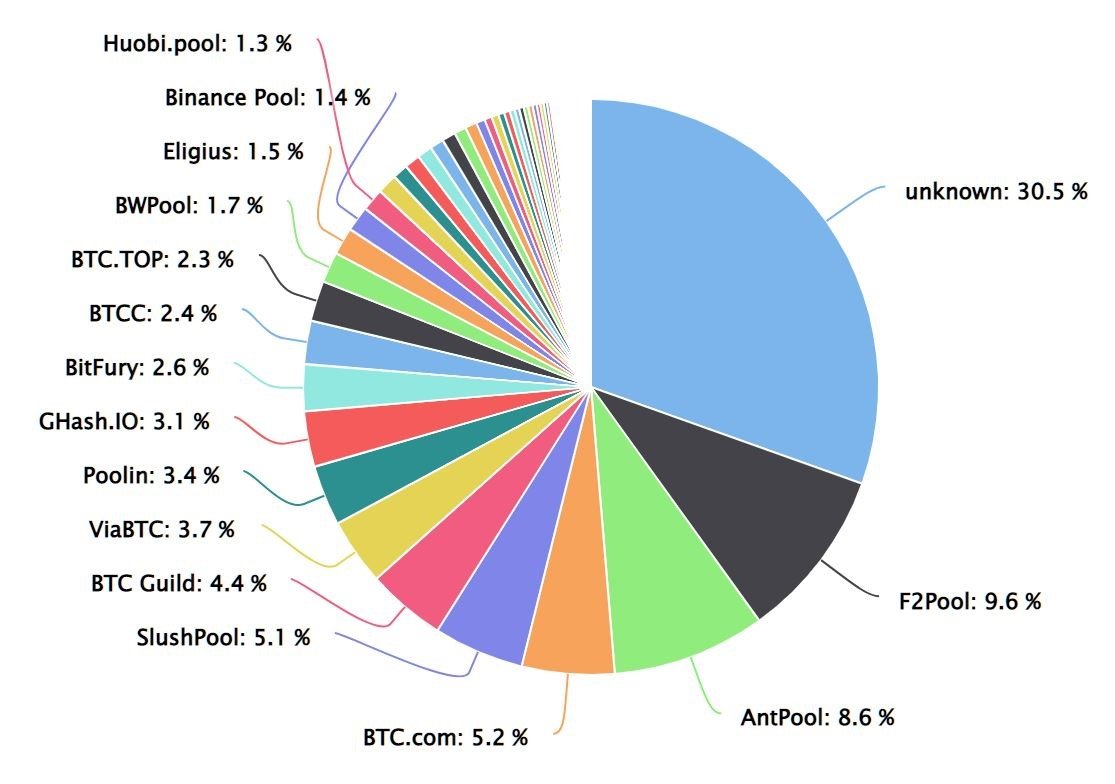

Another metric we should look at is miner decentralization. While the emphasis on this is often over-rated and again, misleading – it is worth looking at:

As you can see, there are 15 dominant mining pools which make up around 65% of the mining share, 30% is unknown and the rest is made up of dozens of very small mining pools.

While the location of these pools is also important, it should be noted that these are only the location of the node operator, the participants are unknown and can be from anywhere in the world. While it is true that a node operator can switch their entire mining pool into an attack against the network, such news would soon become apparent and the majority of miners would switch to an honest pool.

Second-Layer Solutions for Bitcoin

When it comes to Bitcoin development, you just can’t please everyone. There are those that argue Bitcoin needs to scale at a base layer, these big-blockers condemn the idea of using second-layer solutions to increase transaction throughput for Bitcoin as it goes against decentralization ideals. But then there are those that scoff at the thought of increasing the block-size and would rather embrace second-layer solutions, while keeping the Bitcoin protocol as it is. Both have various layers of hypocrisy in their arguments, but its probably best we leave them to it. Bitcoin works, it has no security issues, it has no bugs and has proven consistency in its functionality for over a decade. No other cryptocurrency can make similar claims and therefore maybe the good old saying of ‘Why fix what isn’t broken?’ has a valid case here.

After all, most of the big-blockers who went on to fork Bitcoin to Bitcoin Cash are quite happy now to create other tokens using second layer solutions on the Ethereum network, in fact it is clear most of the cryptocurrency space has fully embraced second-layer solutions. Just look at Binance Smart Chain and Polygon, few new tokens are released solely on the Ethereum network with utilizing these second-layer solutions.

So, a second-layer for Bitcoin, why not?

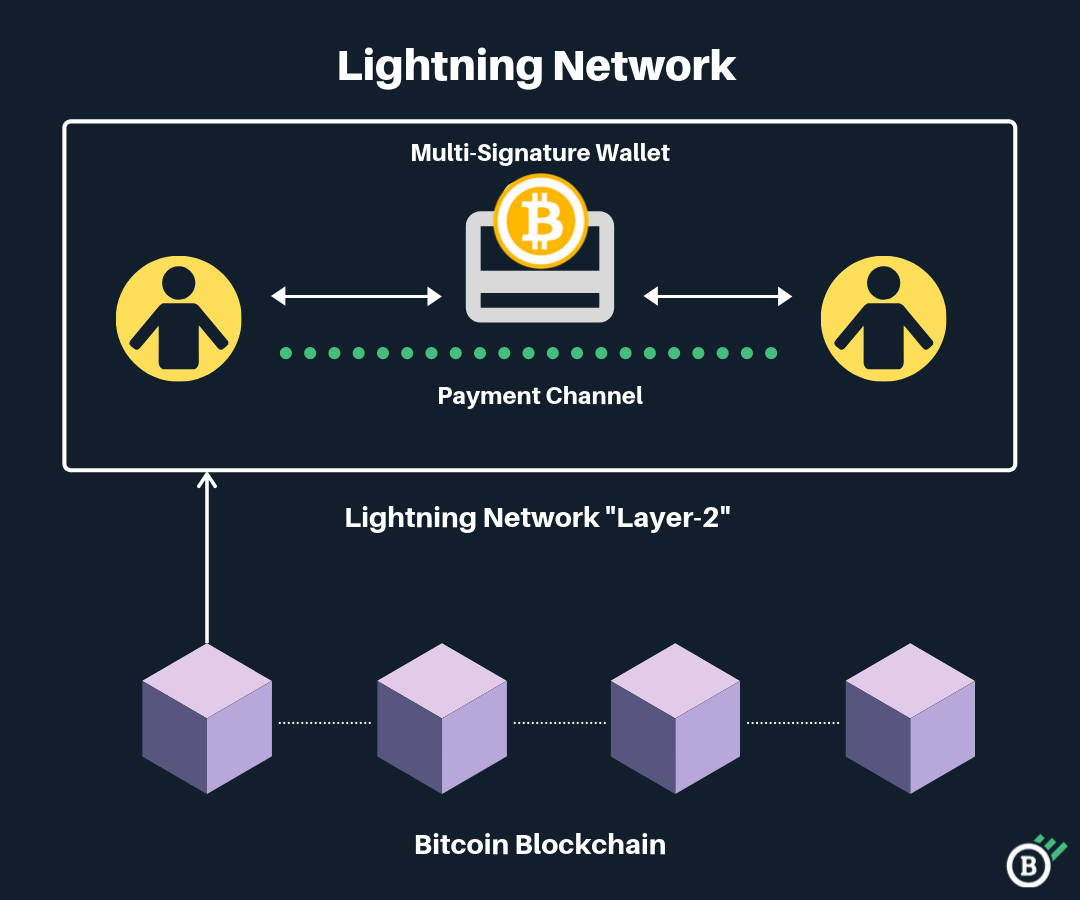

The most well-known second-layer for Bitcoin is the Lightning Network, this allows fast and cheap payments in Bitcoin. The Lightning Network enables billions of transactions per second across the network without waiting for confirmation times. I won’t go into detail about the technicals, but imagine this.

Bob sends 1 BTC from his bitcoin wallet to his Lightning Network (LN) wallet. He waits 10 minutes for confirmation of the transaction. Bob now has 1 BTC in his LN wallet.

Bob wants a coffee, and low and behold, the coffee shop accepts LN payments. Bob gets out his LN wallet app, scans the coffee bill barcode, and the amount of bitcoin required leaves Bobs LN Wallet and is now in the Coffee Shops LN Wallet.

Bob continues to spend his available Bitcoin over the next few months using his LN Wallet, until eventually, ten thousand coffees later his wallet is empty and the LN settles the transaction on the Bitcoin network.

You see, everything that happens from the point of Bitcoin entering the LN is off chain, nothing happens on the bitcoin network except when bitcoin is sent out to a LN Wallet, and then again when it’s received from the LN.

While I’d agree the whole self-sovereignty ethos of Bitcoin is somewhat lost with the Lightning Network, it isn’t quite as much of an issue as many would like you to believe. For one, the LN is also decentralized – anyone can run a node. But also, the Bitcoin network itself is kept intact and can still be used as it always was. LN is an option to enable fast payments, that’s it – no one is asking anyone to store their stack of wealth on the Lightning Network.

I have my own ideals, we all do I’m sure and the Lightning Network certainly doesn’t align with mine entirely, but I’m also rational and understand my ideals are not the ideals of the majority. Most people have never even considered what defines ‘sound money’. Most people care nothing for decentralization and self-sovereignty, most care only about convenience and ease. LN enables bitcoin to enter the world of micro-payments without bloating the chain or changing the bitcoin code.

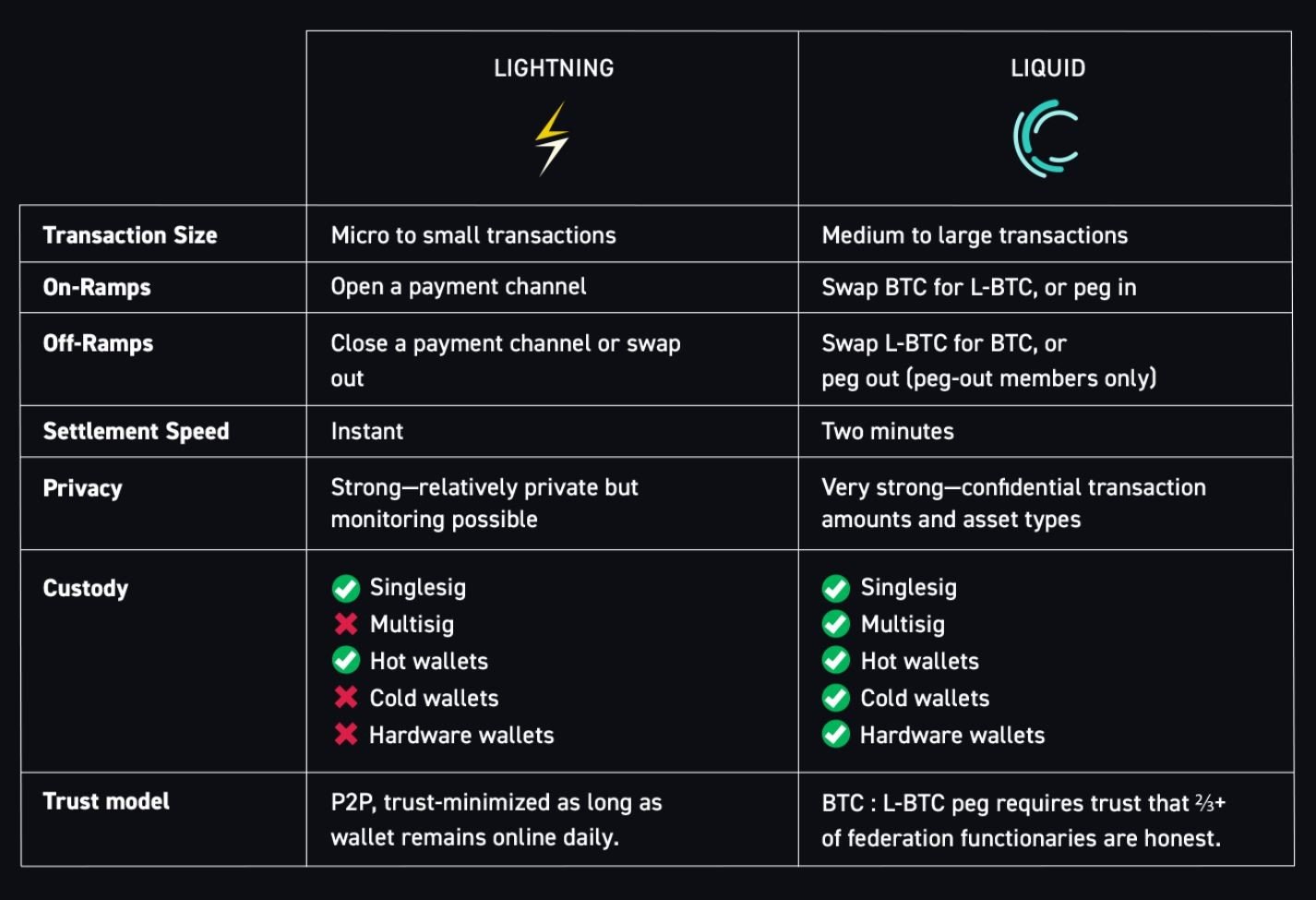

LN utilizes Bitcoins little-known smart contract functionality. Blockstream, the organization behind the Lightning Network also has another second-layer platform for Bitcoin called Liquid.

Liquid is a side-chain, so unlike LN, it has its own blockchain and token which is pegged like for like to BTC, L-BTC.

Liquid opens the door to the same type of applications we see being built on the Ethereum blockchain. But again, it does come at a price, as do all second-layer solutions built for the Ethereum blockchain – the price is trust. For example, Liquid uses a federation model consisting of 15 hardware security modules (HSM) attached to host servers. In order for the liquid network to remain trustworthy and secure it requires at least two-thirds of this 15 to act honestly.

A far superior model to your typical cryptocurrency exchange, but far from perfect. But again, little different to some of the second-layer solutions we see on Ethereum and, might I add, not vastly different to many Proof-of-Stake blockchains. Just look what happened with LUNA recently, a supposed decentralized blockchain and yet within hours consensus was met to halt block production, burn tokens, restart the chain and finally ditch the chain altogether for a new one.

Bitcoin, the underlying asset, is secure and L2 solutions are an option, take them or leave them – but, I suspect most will find the advantages of using them far outweigh the risks.

By the way, I would use these no more than I use centralized exchanges or my bank. A little, when the benefit outweighs the risk. But I’m more skeptical than most and am quite stubborn at sticking to m principles. On the other hand, I’m also quite rational, I understand most are not as sceptical as me, most don’t care about how their transactions are made, how decentralized something is and are unaware of the risks. Most simply bought crypto because it made their friend. Merchants began accepting it because their friend who bought it because their friend go rich told them it would be cool if he could buy his wares with crypto. For most, crypto is just some strange internet money – how it functions and what it stands for, they care not, or at least they think they don’t. In time I believe people will care more, they’ll be forced too – but for now, ease, speed and functionality win the day.

But, even so…. The underlying asset, Bitcoin remains as it is, as it was, as it’s always been. And that for me, is enough.

While more and more people in the space seem to have less and less love for Bitcoin, I think this is less because they have a valid concern with it, but more that it just doesn’t have all the bells and whistles we see with new projects. After all, Bitcoin doesn’t make announcements everyday about partnerships, Bitcoin doesn’t have a telegram group offering free bitcoin and prizes for those that share the bitcoin website on their social feeds. Bitcoin has none of these things because there is no one to do it. Bitcoin has no frontman, mascot or organization to try and catch the attention of newbies in the space. Bitcoin is alone, its continual existence and resilience to time is the only promotion it has.

I’m all for new, all singing, all dancing cryptocurrency projects coming on the scene, but it would be wise to take Bitcoin seriously, it isn’t going anywhere anytime soon, and its majority dominance in the space will continue for many a moon to come. I expect this statement to age well.