“I don’t have any money to invest!” he says, “Investing is for the rich!” he says, I’ve heard it a million times before and no doubt, will hear it a million times again. But this isn’t entirely true. For most there is a way in which we can invest, of course how much will vary, and how we go about it may also vary – but when there is a will, there is a way…… or so they say!

So, in this series I am going to show you just how this is possible and what’s more, I am going to prove it to you by following the strategy myself.

Most of us have things we buy that are needless, they are guilty pleasures or little unnecessary rewards we give to ourself, or maybe just a needless convenience. It maybe a Netflix or spotify subscription, or maybe you are like me and spend way too much on starbucks coffees.

What I want you to do is find something you spend out on frequently, that you really don’t need at all, something you can do with out without any negative impact on reaching your future goals. Something needless, something overpriced.

For me it is going to be coffee. On average, I purchase between 2 to 3 coffees per day for about 5 days a week. It feels more like a needful thing to me, but that’s my caffeine addiction talking, in reality, I could just make myself a coffee for a fraction of the cost or do without it all together[shudder].

To be realistic I will not deprive myself totally of coffee. I will limit my maximum coffee purchases per day to 1. If I want more, I will have to take a flask of water and make it myself.

So now I have freed up funds to the value of 2 x coffees per day x 5. The average price of coffee is about £3.00, so (3×2)x5=£30. That is £30 per week I now have to invest.

Now rather than not spend this £30 and leave it to get wasted on something else, we are going to invest it.

This £30 per week I am now going to invest and because previously these funds were in effect disposable, I won’t worry to much about risk, after all the risk previously to these funds was 100%.

In order for this to work, it needs to be setup in such a way that moving your needless things funds into your investment fund is an easy process. I am going to be using Crypto.com and a clean Metamask wallet which I’ve named ‘Needless Things’.

So here is what I do. When I get that coffee urge, instead of racing to the closest coffee vender in a panic to get my next hit, I purchase £3 of USDC on Crypto.com, then I transfer this over to my Metamask wallet. There is a fee for both the purchase and the withdrawal, but that doesn’t matter, we can afford to take that hit.

So, as I’ve been writing this I’ve done exactly that, though because I planned this yesterday after my first coffee, I’ve included that as well as the one I would undoubtedly of purchased later today. So, my ‘Needless things’ wallet now has £8.80 (£9 – fees)

What we place these funds in from here is up to you, but I’ll show you where I’m putting it, play along if you please.

My first £17.50 from the past few days will be going into DERC and MATIC.

To make this universally easier to financially visualise I will use US dollars as the currency.

|

Token |

Added |

Total |

|

TOTAL INVESTED |

|

$22.50 |

|

Distribution |

|

|

|

Derc |

6 |

6 |

|

MATIC |

7.8 |

7.8 |

Now, I may in time, as this little nest egg matures, diversify profits out into other assets, but for now, this little setup will do us just fine.

If you want to play along, all you need is a bank account, access to a cryptocurrency exchange that allows instant purchases of crypto using your bank and a metamask wallet. All of this can be done from your smart phone.

Don’t use the Ethereum chain on metamask, the fees alone will be higher than our investments. I’m using Polygon and Binance for now as these are both cheap and have the widest selection of tokens available for swaps.

If you are unsure on how to set up alternate chains on Metamask, check out our guides for adding Binance and Polygon on our website, here and here.

Investing doesn’t need to be something ‘Rich people do’, it is something anyone can do and often those ‘rich people’ are only rich because they did exactly this a long time ago. We all spend money on things we don’t really need. Go through your monthly expenses and have a good honest cleanout. Ask yourself, “Is this necessary?”, ask yourself “Would I sacrifice this for being financially free 10 years down the road?”.

It is often these simple changes in a person’s behaviour that have the biggest effect on their future. My example is just using coffee, but maybe you are a smoker, or an excessive drinker – this little strategy can not only help you build a valuable treasure chest, but also motivate you to kick those nasty habits.

It doesn’t matter if you can only invest $5 a week, that is still $260 per year, and invested well, this could easily mature into small fortune over time. As with most things in life, consistency and patience wins the day.

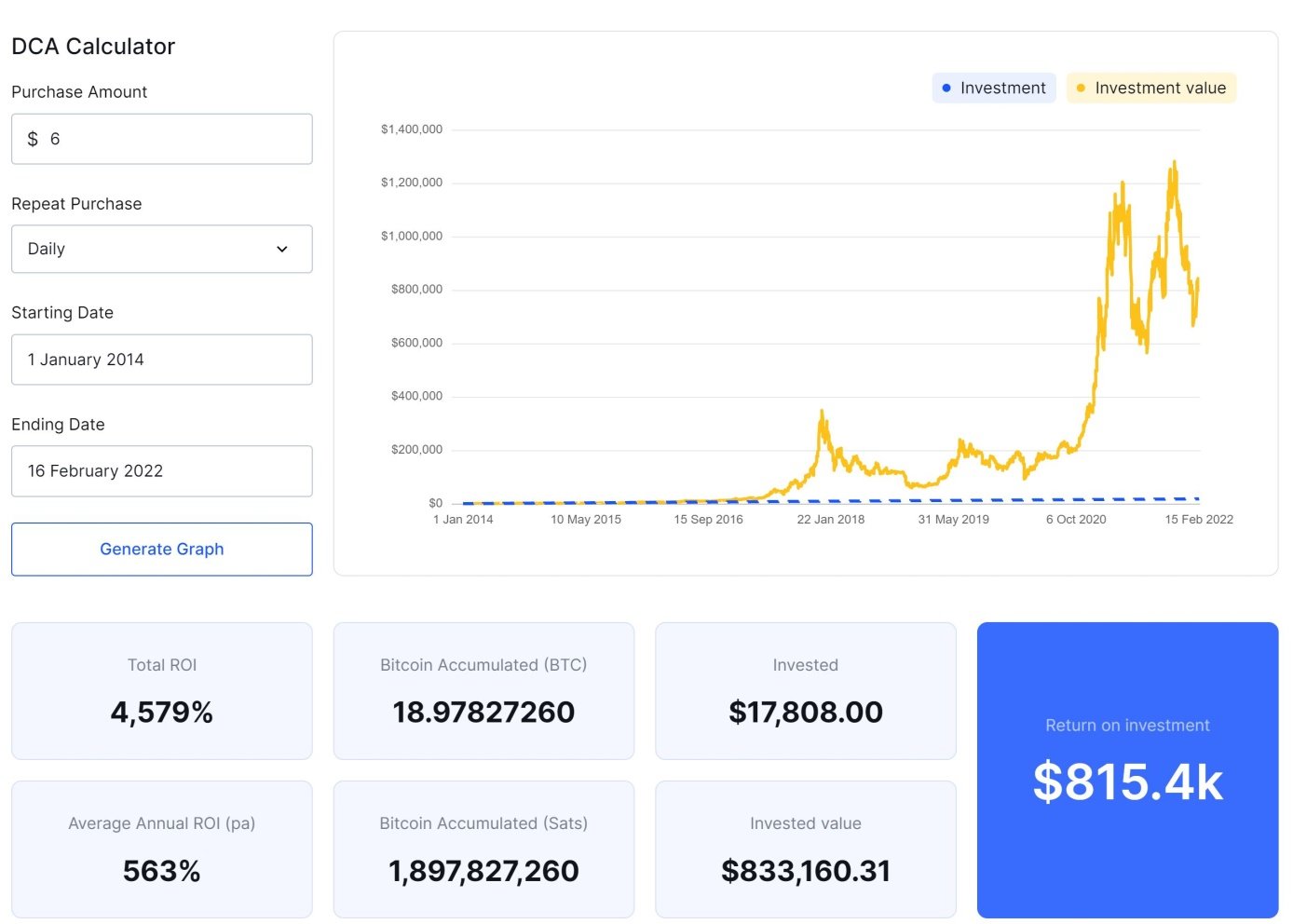

If you think this is a futile investment strategy, think again. If you had invested just $6 a day into Bitcoin from 1st January 2014 to the present day, then your little ‘Needless things’ investment portfolio would look a little something like this:

Next month I will setup a live page on our website to keep track of my ‘Needless Things’ investment portfolio.

Let’s see just how much my caffeine addiction has cost me over the years (well, I think the chart above gives us a rough idea……… I think I’m going to vomit…..)