Don’t we all want ‘to preserve and restore the natural assets that ultimately underpin the ability for there to be life on Earth’? I for sure preserve this noble goal, don’t you?

Well, fear no more since our world leaders are ‘on it’ already.

On September 17th of 2021, the New York Stock Exchange (NYSE) announced it had developed a new asset class and accompanying listing vehicle meant “to preserve and restore the natural assets that ultimately underpin the ability for there to be life on Earth.”

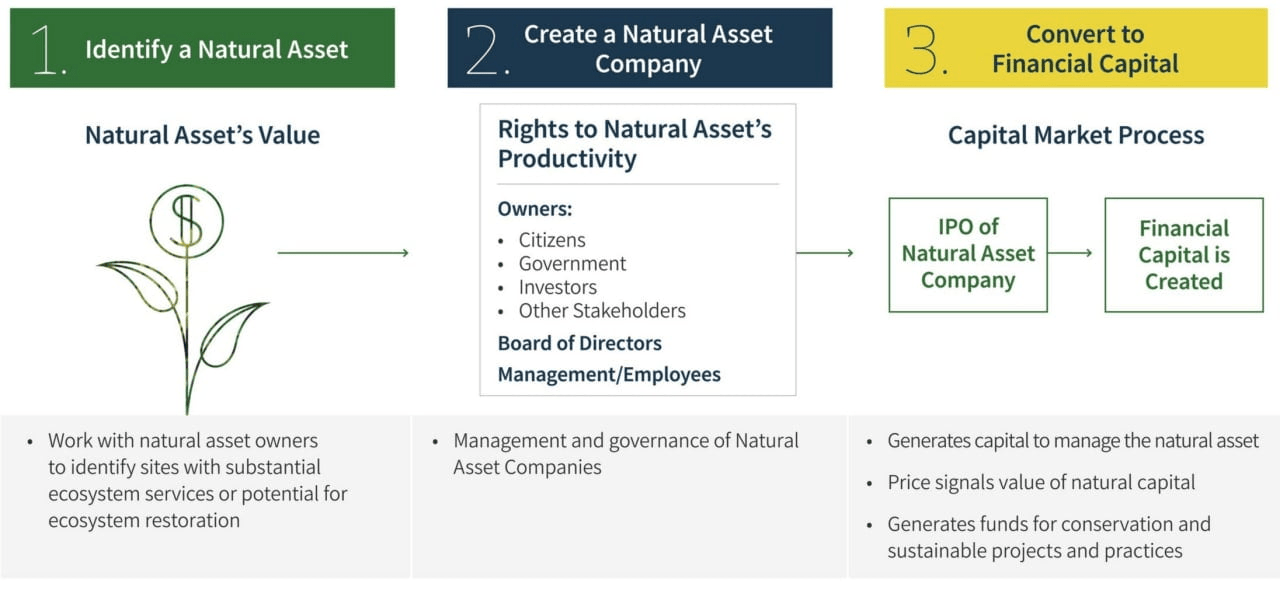

The vehicle, called NAC, or ‘Natural Asset Company’ will allow for the formation of specialised corporations “… that hold the rights to the ecosystem services produced on a given chunk of land. Services like carbon sequestration (= the action of taking legal possession of assets until a debt has been paid or other claims have been met), or clean water.” These NACs will then maintain, manage and grow the natural assets they commodify, with the end-goal of maximising the aspects of that natural asset that are deemed by the company to be profitable.

Though described as acting like “any other entity” on the NYSE, it is alleged that NACs “will use the funds to help preserve a rain forest or undertake other conservation efforts, like changing a farm’s conventional agricultural production practices.” Sounds great so far, or at least not bad, but is it?

The creation and launch of NACs has been two years in the making and saw the NYSE team up with the Intrinsic Exchange Group (IEG) (in which the NYSE itself holds a minority stake). IEG’s three investors are the Inter-American Development Bank (IADB), the Rockefeller Foundation and Aberdare Ventures.

The IADB is the Latin America-focused branch of the multilateral development banking system that imposes neoliberal and neocolonialist agendas through debt entrapment; the Rockefeller Foundation, the foundation of the American oligarch dynasty whose activities have long been tightly enmeshed with Wall Street; and Aberdare Ventures, a venture capital firm chiefly focused on the digital healthcare space. Notably, the IADB and the Rockefeller Foundation are closely tied to the related pushes for Central Bank Digital Currencies (CBDCs) and biometric Digital IDs.

The IEG’s mission focuses on “pioneering a new asset class based on natural assets and the mechanism to convert them to financial capital.” “These assets,” IEG states, make “life on Earth possible and enjoyable…They include biological systems that provide clean air, water, foods, medicines, a stable climate, human health and societal potential.”

Put differently, NACs will allow ecosystems, the rights to “ecosystem services” and the benefits people receive from nature as well, to become financial assets. These benefits include food production, tourism, clean water, biodiversity, pollination, carbon sequestration and much more.

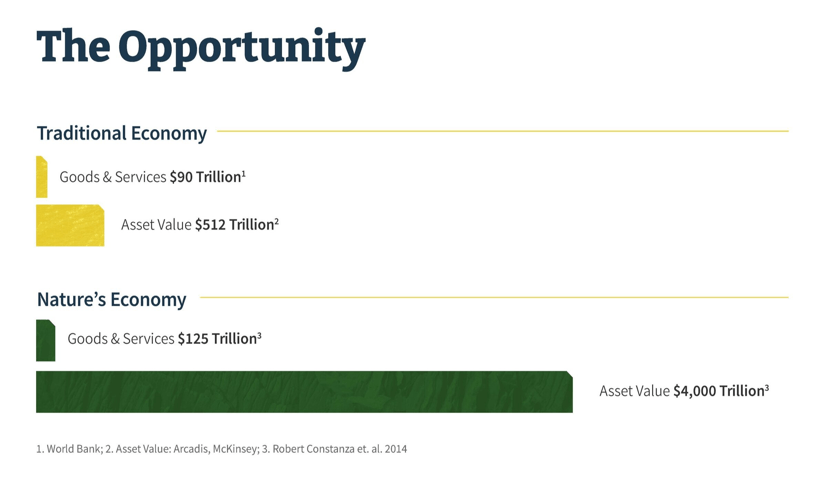

So basically, with NACs, the NYSE and IEG are now putting the totality of nature up for sale. While they assert that doing so will “transform our economy to one that is more equitable, resilient and sustainable”, it’s clear that the coming “owners” of nature and natural processes will be the only real beneficiaries.

NYSE COO Michael Blaugrund (one of the creators) alluded to the ultimate goal being to extract near-infinite profits from the natural processes they seek to quantify and then monetise. “Our hope is that owning a natural asset company is going to be a way that an increasingly broad range of investors have the ability to invest in something that’s intrinsically valuable, but, up to this point, was really excluded from the financial markets.”

Here comes Blackrock and the like…

Framed with the popular green buzzwords of “sustainability” and “conservation”, media reports on the creation of NACS, even in outlets like Fortune, couldn’t avoid noting that NACs open the doors to “a new form of sustainable investment” which “has enthralled the likes of BlackRock CEO Larry Fink over the past several years even though there remain big, unanswered questions about it.”

Fink, one of the world’s most powerful financial oligarchs, has long been and still is a corporate raider, not an environmentalist.

So how are NACs created?

Source: IEG

And what is the potential?

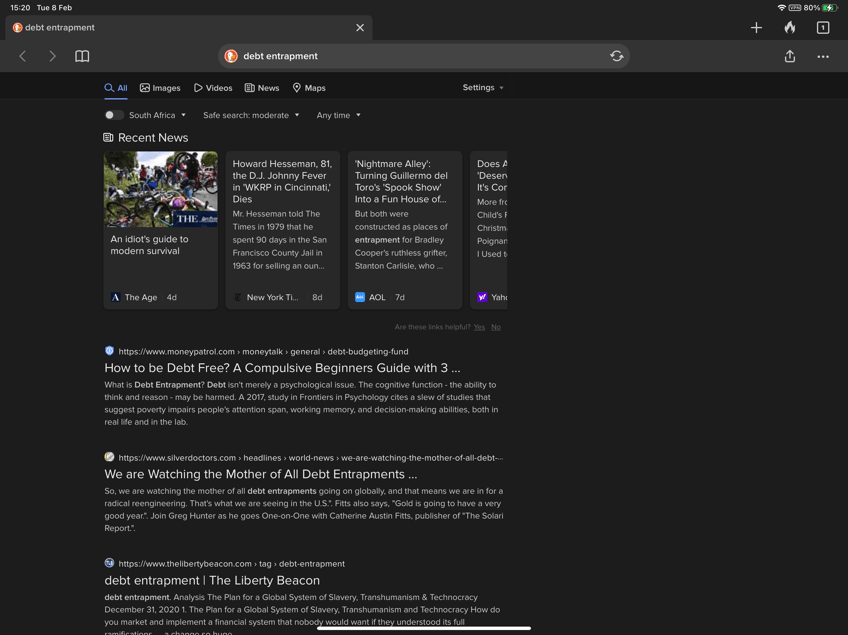

So, after dept entrapment for state owned assets, now dept entrapment for nature’s assets?

Although marketed as sustainable and for conservation, isn’t the underlying real reason pure profiteering in neo-colonial inaction style? What do YOU think is most likely? What do you think is the main purpose of organisations like Rockefeller and Blackrock?

Or is it like Witney Webb states ‘A project of the multilateral development banking system, the Rockefeller Foundation and the New York Stock Exchange recently created a new asset class that will put, not just the natural world, but the processes underpinning all life, up for sale under the guise of promoting “sustainability.”

And a fun observation. While working on the above article I used Google for the word ‘debt entrapment’ and I got the following results:

Then, using DuckDuckGo I got this:

Weird, no?

Which browser do you prefer? And why do you think we get such differing results?