Central Bank Digital Currencies have been all the talk for sometime within the alternative news and community groups. The greatest fear for many seems to be the traceability and control aspect that is associated with them.

These currencies and the wallets that hold them will be programmable. If you owe the taxman money, or get a parking ticket, an automatic routine can be enabled that deducts a percentage of all funds coming into your account until the extortion is fulfilled. This will likely go one step further and save the hassle of collecting debts, but rather automatically tax all incoming funds that enter your account.

But it could go deeper, maybe there is a pandemic going on? Maybe you are not an essential worker and should be locked in at home…

But maybe you want to drive 100 miles north to see your ageing mother who is all alone. So you head off to the fuel station to fill up on diesel. Sorry, the computer says no. CBDCs will be able to determine if you are eligible to use your funds based on current state orders and protocols. Want to buy 24 eggs in the middle of the eggpocalypse we find ourselves in? Sorry, only 6 eggs per person a day, the computer says “NOPE!”.

CBDCs give tyrants an efficient way to enforce any ridiculous societal restriction they chose.

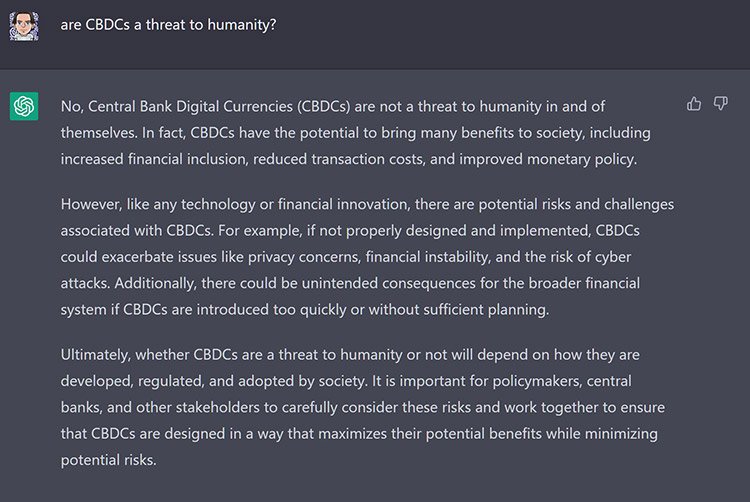

Before I continue further, what did everybodies new best friend over at OpenAI have to say on the matter?

A little bit too supportive of the concept in my opinion – but our little AI shill isn’t wrong.

‘whether CBDCs are a threat to humanity or not will depend on how they are developed, regulated, and adopted by society’

Without adoption there is no threat.

So, whether or not it enslaves humanity is ultimately up to humanity. Adoption requires, well, adoption and so far CBDCs are not winning many popularity contests.

India’s recent trial of the e-rupee didn’t exactly excite anyone:

Bankers said they had been initially enthusiastic but now wondered whether financial institutions would want to keep using the e-rupee.

“I don’t think once the pilot is concluded, without any RBI pressure, banks will want to use it,” the private banker said. – source

And if you are struggling to get bankers to use it, do you really think consumers have any interest in this? What is the benefit to consumers?

Absolutely no benefit whatsoever.

I believe cryptocurrencies will outpace CBDCs. We already have over a decade on the central banks in this technology. We have already built a one trillion market cap economy. The tools are here, the wallets are here and the adoption is only growing more every year. Most central banks have an estimation of their CBDC launch somewhere around 2030. That’s another 6 years away. Bitcoin and other cryptocurrencies will blow anything they can offer the public out of the water.

They’ know they’re too late to the party. This from the ECB says it all!

In a stark warning, the European Central Bank (ECB) said in a report published today that governments that opt out of introducing central bank digital currencies (CBDCs) may face threats to their financial systems and monetary autonomy. – source

Cryptocurrency is already saving populations from the negative effects of the central banking cartel’s legacy economy.

Look no further than Turkey to see how cryptocurrency is not only being adopted, but begged for. As inflation sores above 80%, the purchasing power of the Lira is falling by the day. To safeguard against this hyperinflation Turks have taken to USDT, Bitcoin and even SHIBA as their main store of value.

We’ve seen similar stories all over the world over the past decade and it is undeniable that cryptocurrency is the ultimate weapon against a failing economy. Will CBDC offer you such refuge? No, in fact they will just give more tools at the state’s disposal to protect themselves from their own failings.

Trouble in the air? Major bank collapsing? Quick draw all your money out…

Oh, computer says ‘NO!’