The Panther Protocol’s native token ZKP has been a part of my crypto-portfolio for some time, and I’ve mentioned it numerous times in our community group chat, as well as writing more detailed insights into the privacy features of the project in previous newsletters. But what I have skipped around for the most part is its potential value both to the space as a whole and for ZKP token holders.

Before I continue, a quick reminder of what the Panther Protocol is:

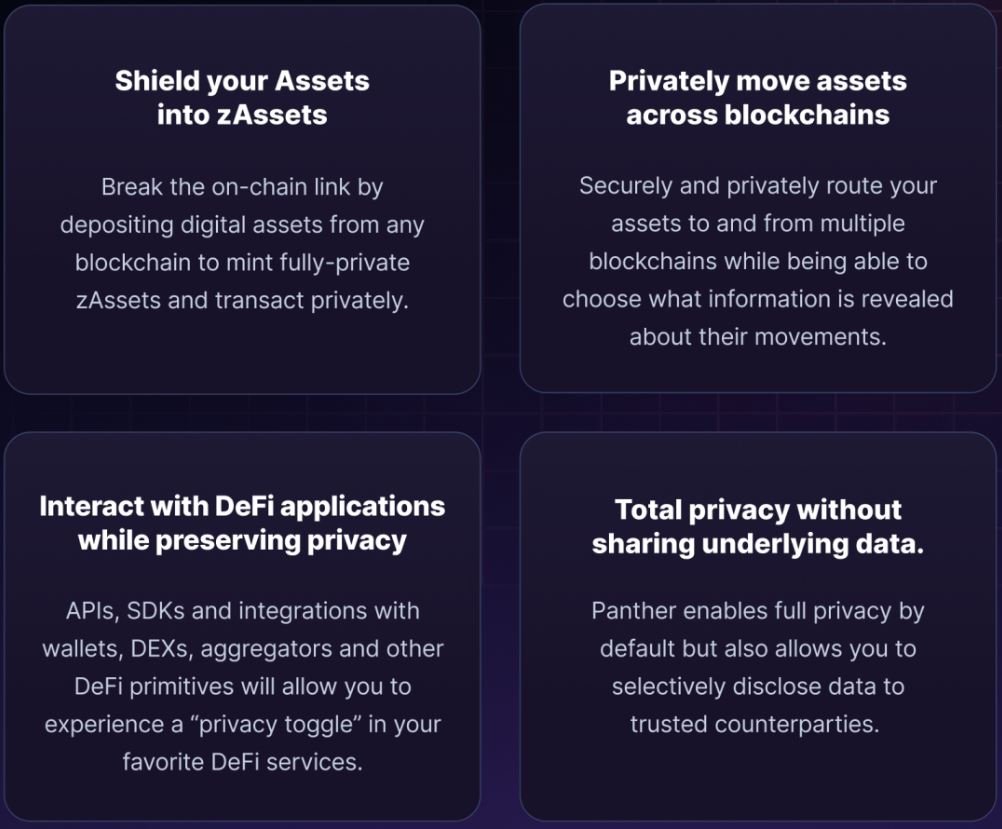

The Panther Protocol is a decentralized protocol that enables privacy in decentralized finance (DeFi) using zero-knowledge proofs. It allows users to mint fully-collateralized, composable tokens called zAssets, which can be used to execute private, trusted DeFi transactions across multiple blockchains.

Panther has built a generalizable, cross-chain protocol that enables a “privacy toggle” for managing digital asset transactions. It enables the creation of interoperable, zero-knowledge assets collateralized 1:1 by their original counterparts.

What makes Panther different to other privacy solutions?

Firstly, I think it is important to understand what Panther isn’t.

- The Panther Protocol is not a cryptocurrency.

- The ZKP token is fully transparent just like any other ERC20/PLG20 token – it has no privacy features in and of itself.

The Panther Protocol simply offers anyone to transact with any crypto-asset in a private way. Panther vaults ensure the security of cryptocurrency assets and provide zAssets as a result. These zAssets are backed by their underlying assets on a one-to-one basis, meaning that for each zUSDC, zETH, or zBTC, a fully collateralized synthetic of the respective asset is generated privately.

ZAssets can be swapped within the vault via a DEX interface and at any time they can be settled for their represented asset.

Unlike other privacy solutions like Monero and Piratechain, where both the sender and recipient are required to have and want the same asset, Panther allows the sender and recipient to transact privately using a wide range of non-private assets.

Key features of Panther Protocol:

- Privacy for any digital asset. Panther Protocol’s privacy features can work with any digital asset on any public blockchain, regardless of its type or layer. These blockchains are referred to as ‘peerchains’. Panther’s goal is to enable their zAssets to be used in DeFi applications across all peerchains.

- Interoperability. Since it’s unlikely that one blockchain will dominate all others, cross-chain transactions will always be necessary. Panther Protocol will have a private interchain DEX module that will facilitate these types of transactions.

- Confidentiality. Panther Protocol allows users to choose how much privacy they want for each transaction. They can even selectively reveal information to satisfy the needs of the other party or regulatory requirements.

The Adoption Problem

The cryptocurrency space is diluted with thousands of projects. In the privacy sector alone, there are almost 100 different cryptocurrencies listed on Coinmarketcap. Entering this very tribal space with a new project is daunting for any developer, how do you convince people to ditch their long-time preferred private asset for another? You don’t!

Hardened Monero advocates are not going to switch to Pirate Chain and OG Zcash disciples aren’t going to begin using Monero anytime soon. This space is tribal, very tribal (didn’t you notice?).

Fortunately, Panther isn’t asking anyone to download a new wallet and ditch their longtime love affair with Monero or some other privacy coin. The Panther Protocol is simply providing a decentralised privacy solution for all cryptocurrencies on any chain.

This makes the adoption process a far easier hurdle to conquer. The protocol can potentially offer utility to anyone who transacts with any cryptocurrency!

The Regulatory Problem

Because the panther protocol itself is not an asset, it does not fall victim to the same issues solutions like Monero and Pirate Chain do.

Over the past couple years we have seen more and more exchanges drop privacy coins due to regulatory issues or for ‘fear’ of regulatory issues.

‘In compliance with UK regulations, Kraken (Payward Ltd) will no longer be supporting Monero (XMR) on its platform.’ – source

This growing problem does not affect the Panther Protocol. The token ZKP has no privacy features in and of itself, and so exchanges can list it just as they list any other ERC20 token.

Is ZKP a Sleeping Giant?

I’m not a fan of price predictions and ‘hot picks’. The cryptocurrency space is full of influencers telling their audience that one shit-coin or another is ‘going to the moon!’, we don’t need any more. But we should talk about where ZKP gets its value from, as ZKP alone has no privacy features, and what exactly is a real expectation for that value.

What is ZKP used for?

- $ZKP can be privately staked to earn rewards for adding tokens to Pools and increasing the anonymity set. Panther can act as a price discovery mechanism for privacy, bringing in new users for a positive feedback loop, eventually lowering the cost of privacy.

- Bootstrapping the growth of the Protocol by encouraging the DAO to buy back $ZKP tokens to create reward programs.

- Relayers pay fees privately on behalf of users, furthering anonymity, to earn $ZKP.

- Governance-focused staking to encourage long-term governance participation.

- $ZKP can be staked to secure the interchain bridges in an AMM model.

- Be optionally used by users to pay for services on the platform at a discounted rate, such as:

(i) to pay mint and burn fees associated with zAssets;

(ii) to pay transaction fees for sending zAssets;

(iii) to pay Panther Reveal fees;

(iv) to pay for DEX trades.

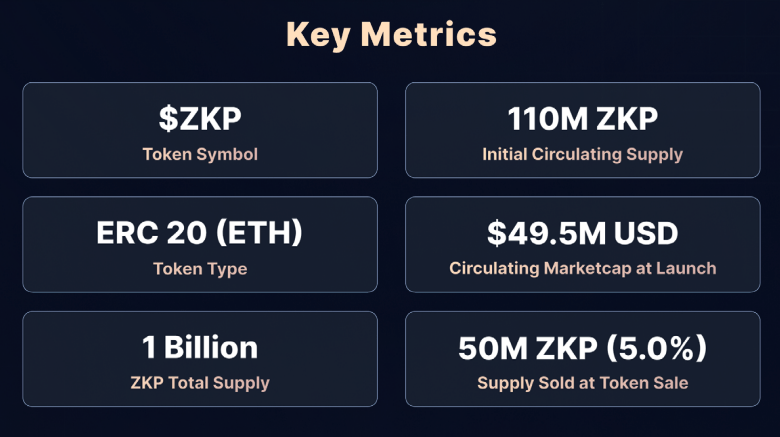

ZKP Pre-sale price: $0.03

ZKP Public Sale price: $0.60

ZKP Current price: $0.03471

ZKP Ranking on CMC: #4271

Right now, ZKP has little utility. It is used for voting in DAO proposals and for testing out some of the staking functionality in beta, but until the release of the Panther Protocol V1, ZKP is little more than a speculative asset.

Comparative utilities token

To get an idea on the potential value of a token it is always wise to see how similar tokens are priced. In the case of ZKP I think our closest match is DEX based tokens like Uniswap or 1Inch for example. Both tokens offer utility behind the platforms they represent. So, we’ll start there.

UNI current price: $6.25

UNI all-time high: $40.00

UNI ranking on CMC: #20

UNI is actually a great comparison because its maximum circulating supply is equal to that of ZKP, 1 billion tokens.

But ZKP potentially has more utility than UNI, it offers privacy for all. It is very hard to predict just how much people will value privacy, but if Monero is anything to go by, it would be safe to assume… quite high.

Right now ZKP is just a little above what early investors paid for their tokens in the pre-sale and it is almost 20x cheaper than the $0.60 it was sold for in the public sale.

A realistic pricing for ZKP as we move towards the V1.0 release later this year and into the next bull market would be somewhere between $3 – $10.

Of course this is all based on the assumption that developers successfully get the protocol up and running, and running without major security issues.

Consider my relatively conservative prediction of $3.00. That is a 10,000% ROI. A pop to $10 in a bull market would take this to a 33,333% ROI.

⚠️ This is not investment advice and you should seek professional financial advice before commiting to any investment.